The unbundling of banks – are business services next?

Banks, if they are astute, should be reflecting carefully about what has happened to daily newspapers in recent years. They survived the arrival of 24-hour cable news, but the rise of the internet has coincided with a slide in newspaper readership numbers. Newspapers are general interest publications, covering news, sport, culture, and much more. So, apart from the newspaper’s main focus – news – readers can now go to specialised websites for the same information. Newspaper websites have kept the news junkies, but they have lost many of those who read the film reviews or browsed property section.

In effect, newspapers have been unbundled.

Similarly, retail banks offer a diverse portfolio of products and services, and these services are also being unbundled. People are going directly to a number of specialist providers competing with banks on price and service. Consumers can now find alternatives for almost any bank service – current account, money transfer, loans, savings, and so on.

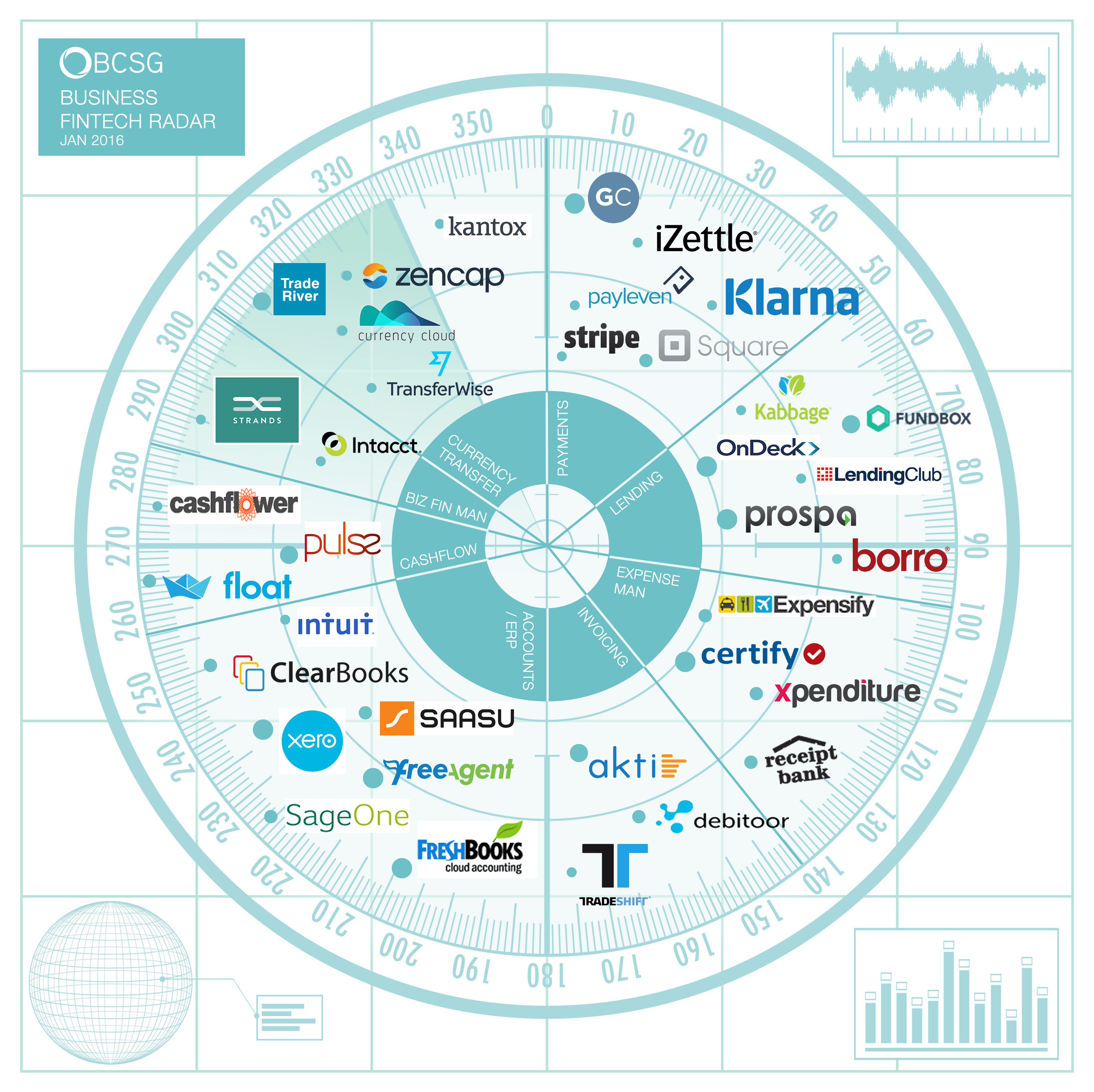

This problem is not limited to consumer banking, though that is where the effect most visible. To date FinTech disruption has been focused almost exclusively on consumer services with payments accounting for nearly half of all UK FinTech revenues. Meanwhile SME and corporate banking services have only faced competition from P2P loan companies and a few niche players in other sub-sectors.

But there are signs that this is changing.

Our recent study ‘Redefining Digital Banking for Small Businesses’ revealed that the relationship between retail banks and their SME customers is weakening and there is increased risk of switching financial service provider. Banks currently have little dialogue either face to face or via digital channels.

An astonishing 73% of SMEs having no contact whatsoever with a relationship manager. As a result 67% of UK SMEs are now happy to look elsewhere for financial services and more than half are tempted to switch banks.

The irony is that the banks’ shift to digital, while necessary and eminently sensible, is partly to blame. Banks are right in adopting a digital-first approach, but it means they are now reactive customer service outlets focused on transaction processing. They are also not providing the support and guidance that SME’s crave. The research revealed that 67% of SMEs want tools and guidance on running their business and planning for growth and development.

So what should banks do? Rather than compete, banks should instead consider making themselves a vital part of the ecosystem. Instead of accepting the inevitable shift from trusted advisor to a utility provider banks need to change their approach by working with new fintechs and other third parties rather than against them.

This gives banks an opportunity to better understand their customer, offer more pertinent guidance and drive engagement. This will prevent churn, open up a new revenue stream, and improve customer relationships.

Banks have a choice. They can compete directly with the more agile companies that can afford to take risks and bring services to market faster without being hampered by legacy systems. However, there is a real risk they will lose this battle and become relegated to a utility, will specialists providing a range of niche services. The alternative is that banks augment these third party products and tools, retaining their position in the value chain.

Augmenting rather than competing is essential if banks are to avoid the unbundling of business services.

To find out more about enhancing digital banking for small businesses and find out why 47% of SMBs are tempted to switch bank accounts, download our research, Redefining Digital Banking for Small Businesses: